- This event has passed.

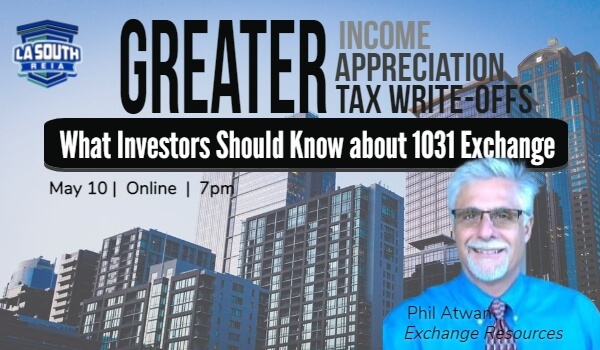

Main Event: What Investors Should Know about 1031 Exchange

Free – $39

GREATER INCOME, APPRECIATION, & TAX WRITE-OFFS

What Investors Sould Know about 1031 Exchange

Investors, we are in for a treat at this month’s Main Event! LA South REIA is pleased to welcome one of Southern California’s most experienced 1031 exchange specialists and founder of Exhange Resources, Mr. Phil Atwan. For investors sitting on a lot of equity and wondering about your next steps, Phil joins us to share:

What’s Happening in the World of the 1031 Tax Deferred Exchange?

- IRS Do’s and Don’ts & The different kinds of 1031 Tax Deferred Exchanges

- Proposed White House Changes to Real Estate, the 1031, and Taxation

- How to create greater Income, Appreciation, and Tax Write-offs for Real Estate Investors

- Your Questions, and my Answers!

About our speaker:

Phillip Atwan is one of Exchange Resources, Inc., Founders. He also speaks to more Financial, Real Estate, and Legal Professionals about 1031 Tax Deferred Exchange than probably anyone in the country. Phil is featured at approximately 120 – 150 education seminars per year, hosted by Financial Planning organizations, Escrow Associations, CPA & EA Tax Groups, Bar Associations, and Real Estate Companies and Title Insurance Companies in the greater Los Angeles area through San Luis Obispo county. His reach extends across the nation; industry-related professionals and Real EstateInvestors from New York to Seattle to Southern California call him to learn about the rules of code section 1031 and how to defer capital gain taxes. Helping and Educating people is work Phil greatly enjoys – and thrives on. He also speaks regularly at Board of Realtor continuing Education functions and has long served in various Board of Director and official capacities for the Escrow Associates of the San Gabriel Valley. Phil began his career in 1982 in marketing and sales with a large title insurance company and transitioned in a 1031 Tax Deferred Exchange focus in 1998. He grew up in Pasadena, CA, and now lives with in Whittier.

Agenda:

7:00-7:30: General Meeting and Market Updates

7:30-9:00: Phil Atwan, 1031 Exchanges